8 Tips for Finding Your New Home

Posted by Brian Pearl on

A solid game plan can help you narrow your homebuying search to find the best home for you.

House hunting is just like any other shopping expedition. If you identify exactly what you want and do some research, you’ll zoom in on the home you want at the best price. These eight tips will guide you through a smart homebuying process.

1. Know thyself.

Understand the type of home that suits your personality. Do you prefer a new or existing home? A ranch or a multistory home? If you’re leaning toward a fixer-upper, are you truly handy, or will you need to budget for contractors?

2. Research before you look.

List the features you most want in a home and identify which are necessities and which are extras. Identify three to four…

1832 Views, 0 Comments

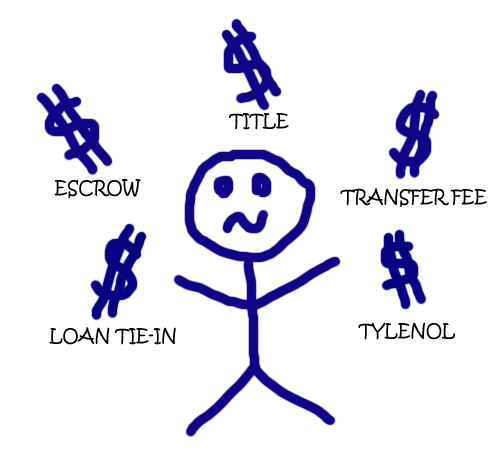

It's very common to see a purchase contract with provisions for prorations. This type of contract should be read closely and you should understand the prorations before signing. It may even be necessary to request a change to the verbiage used for the prorations.

It's very common to see a purchase contract with provisions for prorations. This type of contract should be read closely and you should understand the prorations before signing. It may even be necessary to request a change to the verbiage used for the prorations.